AI Fraud Detection in Crypto Transactions: How It Works & Why It Matters

May 22, 2025

Let’s face it, the world of cryptocurrency is fast, thrilling, and full of opportunity. But with that speed comes one serious downside, fraud. In 2026 alone, global losses from crypto-related fraud surged to a staggering $3.4 billion, according to a recent blockchain security report. The takeaway? As digital assets continue to go mainstream, the need for AI fraud detection has never been more urgent.

Unlike traditional finance, crypto operates in a decentralized, anonymous environment, and fraudsters love that. From fake token launches to sophisticated phishing schemes, the crypto space has become a playground for hackers. But the game is changing thanks to AI in blockchain security.

A quick reality check:

- In 2025, fraud-related losses in DeFi crossed $2.8 billion. In 2026, that number jumped by 21%, driven by targeted smart contract attacks and identity spoofing.

- Traditional fraud detection systems miss anomalies due to sheer data volume. In contrast, AI-powered crypto transaction monitoring tools process millions of transactions in real-time.

- Thanks to blockchain anomaly detection, false positives in fraud alerts have dropped by 38% in next-gen platforms.

Today’s top crypto platforms are going beyond simple alerts. They’re leveraging blockchain anomaly detection, advanced analytics, and AI-powered crypto transaction monitoring to stay one step ahead of fraudsters.

What you’ll discover in this blog:

- How AI detects fraud in cryptocurrency transactions

- How to implement AI-based fraud detection in DeFi platforms?

- Real-world technologies behind DeFi fraud detection

- Challenges of using AI for detecting crypto frauds

- Role of AI in enhancing security of crypto exchanges

So, ready to dive into the smarter side of crypto security? Let’s unpack how AI fraud detection in crypto transactions is changing the game.

What Is Crypto Fraud and How It's Evolving Over Time

Cryptocurrency fraud encompasses deceptive practices aimed at exploiting digital currencies for illicit gains. Over the years, these schemes have evolved from rudimentary phishing attacks to complex operations involving AI-generated deepfakes and synthetic identities. The decentralized and pseudonymous nature of blockchain technology presents unique challenges, making traditional digital asset fraud detection methods less effective.

What Is Crypto Fraud Detection?

Crypto fraud detection involves identifying and mitigating fraudulent activities within cryptocurrency ecosystems. This includes AI transaction monitoring for anomalies, verifying user identities, and ensuring compliance with regulatory standards.

Let’s simplify it, Crypto fraud detection is the process of identifying unusual, unauthorized, or suspicious activities within digital asset transactions and stopping them before they wreak havoc.

Modern crypto transaction monitoring tools go far beyond basic rule-based alerts. They use machine learning in crypto security to process high-frequency, high-volume blockchain data.

- Real-time analytics flag anomalies using historical behavior patterns.

- Detects irregular transaction spikes, wallet activity, and chain-hopping patterns.

- Powers next-gen AI in blockchain security solutions.

- Prevents fake account creation using biometrics and behavioral analysis.

- Some platforms integrate AI techniques for preventing money laundering in crypto to stay compliant.

- Uses supervised and unsupervised learning models to spot fraud even in zero-day exploits.

- Tools like DeFi fraud detection engines learn over time, improving accuracy with every transaction processed.

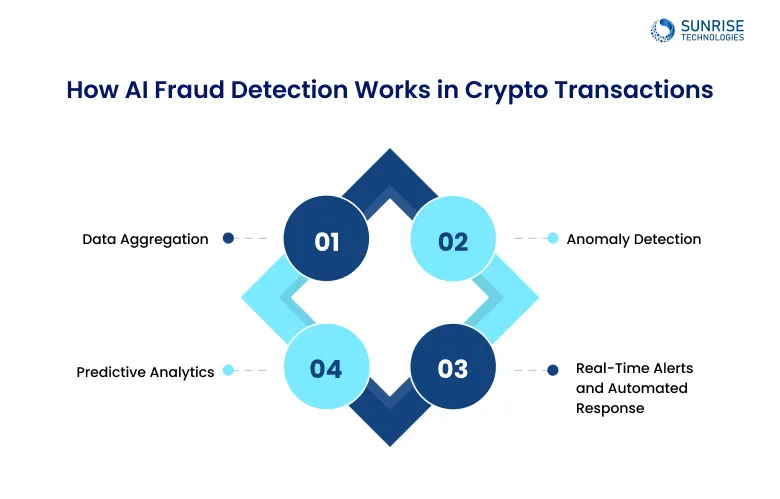

How AI Fraud Detection Works in Crypto Transactions

How does AI detect fraud in cryptocurrency transactions? It leverages the ability of machine learning algorithms to analyze massive datasets of crypto transaction information and identify patterns indicative of fraudulent activity. Here’s a breakdown of the process:

Before AI fraud detection can work its magic, it first needs to gather fuel, data. And it doesn’t just look at the blockchain. AI tools extract on-chain data like wallet addresses, token transfers, gas fees, and transaction timestamps.

Simultaneously, they collect off-chain metadata such as:

- IP addresses

- Device IDs

- Browser fingerprints

- Geolocation patterns

AI models are trained to spot the slightest deviation from normal behavior, flagging suspicious activity in real-time before damage is done.

- Supervised Learning: Algorithms like logistic regression, support vector machines (SVMs), random forests, and gradient boosting machines are trained on labeled data to classify transactions as either fraudulent or legitimate.

- Unsupervised Learning: Algorithms like clustering (e.g., K-means, DBSCAN) and anomaly detection techniques (e.g., isolation forest, one-class SVM) are used to identify unusual patterns and outliers in transaction data without prior knowledge of specific fraud types. This is particularly useful for Blockchain anomaly detection and identifying novel fraud schemes.

Graph Analysis

- AI maps wallet-to-wallet connections, tracking how funds move through the ecosystem.

- Tools like Elliptic’s AML system leverage this to uncover money laundering rings or mixer patterns.

- These insights are crucial for AI techniques for preventing money laundering in crypto.

For more proactive detection, AI uses labeled datasets to make predictions about new transactions. Algorithms like Random Forest and XGBoost are trained on historical fraud cases.

They predict the likelihood that a transaction is suspicious, based on features like:

- Transaction size

- Token type

- Time of day

- Previous wallet history

Time-Based Detection

- Long Short-Term Memory (LSTM) models analyze sequences of events.

- Perfect for spotting fraud that unfolds over time, like slow-drip exploits or staged laundering.

Speed is everything in fraud detection. AI doesn’t just analyze, it acts.

- APIs integrated into exchanges or wallets issue real-time alerts.

- Suspicious transactions can be automatically flagged or frozen before they’re confirmed.

- Solutions like Chainalysis Oracle exemplify this, combining deep analytics with real-time prevention.

So, when someone asks “Can machine learning identify fraudulent blockchain activities?”, the answer is a resounding yes through smart data aggregation, real-time intelligence, and continuous learning, AI becomes your crypto platform’s 24/7 watchdog.

Sunrise Technologies brings deep expertise in AI and blockchain to secure your platform with a safer, smarter DeFi experience.

Benefits of AI in Crypto Fraud Detection

Leveraging AI in the realm of crypto fraud detection isn’t just a technological upgrade, it’s a necessity. From real-time transaction monitoring to predictive intelligence, here’s how AI is reshaping fraud prevention in the crypto-fintech space:

AI systems continuously scan blockchain activity, identifying suspicious patterns like wallet address anomalies, transaction spikes, or unusual trading behaviors.

With machine learning in fintech, AI models learn from user behavior and flag deviations. Whether it’s a sudden withdrawal spree or abnormal login locations, anomalies are instantly spotlighted.

Unlike rule-based systems, AI evolves. It adapts to new fraud tactics, reducing false positives and catching threats that traditional systems would miss, with minimal manual tuning.

AI simplifies compliance by verifying user identities, cross-referencing global databases, and spotting laundering patterns, helping crypto platforms stay ahead of regulatory expectations.

AI predicts which transactions or wallet addresses are high-risk, empowering platforms to block, delay, or investigate before fraud occurs.

From onboarding to withdrawals, AI provides a transparent, end-to-end view of all user actions, making investigation faster and more accurate when fraud hits.

Challenges and Limitations of AI in Crypto Fraud Detection

While AI fraud detection brings transformative power to the fight against cryptocurrency scams, it’s not without its roadblocks. As advanced as AI models are, they still face real-world complexities, especially within the decentralized, high-speed world of blockchain.

Let’s break down the major hurdles:

When you’re dealing with massive amounts of sensitive blockchain and user data, data Privacy becomes main oncerns in Cryptocurrency Fraud Prevention

- AI in blockchain security often requires access to off-chain metadata (like IP addresses and device IDs), raising questions about data sovereignty and GDPR compliance.

- Balancing cryptocurrency fraud prevention with ethical AI practices remains a tightrope walk for organizations.

One of the biggest challenges is the ever-evolving nature of fraud techniques.

- Malicious actors use advanced methods like AI-generated phishing messages, synthetic identities, and DeFi risk management.

- To stay effective, models built for machine learning in crypto security must continuously retrain on fresh datasets to keep up with new attack vectors.

AI sometimes gets it wrong, and when it does, it can disrupt legitimate users, false positives in crypto transaction monitoring

- Overly aggressive anomaly detection can trigger false alerts, especially in crypto transaction monitoring for high-frequency traders.

- These AI techniques for preventing money laundering in crypto need a careful balance between sensitivity and specificity.

AI isn’t plug-and-play, it demands investment.

- Building a reliable DeFi fraud detection system means deploying heavy-duty models, infrastructure, and real-time analytics engines.

- Smaller crypto exchanges or startups may struggle with the high costs of AI implementation and the lack of skilled resources to maintain them.

Stay ahead of fraud with intelligent, real-time detection systems tailored for your crypto business.

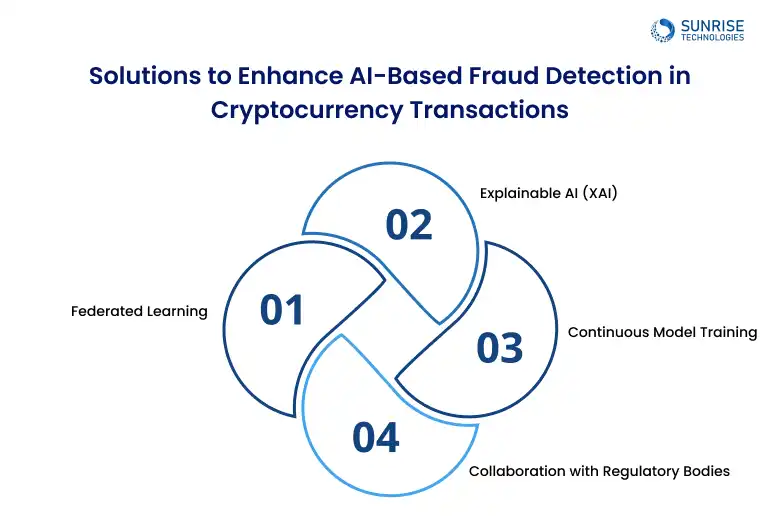

Solutions to Enhance AI-Based Fraud Detection in Cryptocurrency Transactions

AI fraud detection systems can be enhanced with the following strategies to overcome challenges and improve cryptocurrency fraud prevention:

Federated learning enables AI to learn from decentralized data without exposing sensitive information, addressing privacy concerns. It helps improve AI in blockchain security while ensuring compliance.

Explainable AI (XAI) provides insights into how AI makes decisions, boosting trust in machine learning in crypto security. It enhances transparency, crucial for DeFi fraud detection.

Regular updates to AI models ensure adaptability to new fraud patterns, vital for cryptocurrency fraud prevention. This keeps systems efficient against evolving threats.

Working with regulatory bodies ensures compliance with AML and KYC standards, improving DeFi fraud detection. It strengthens the legal framework for AI-based fraud detection.

Read Also: Top AI-Powered Cryptocurrencies to Watch in 2025

Real-world examples of AI fraud detection in crypto transactions

- 1. Chainalysis Chainalysis uses AI-driven algorithms to monitor blockchain transactions and detect suspicious patterns linked to scams, money laundering, and darknet activities. Their solutions have been instrumental for law enforcement and crypto exchanges in flagging illicit funds in real time.

- 2. Binance Binance has implemented AI and machine learning models to assign risk scores to every transaction. Their AI systems analyze user behavior, geolocation, and trading patterns to identify anomalies and prevent fraudulent withdrawals or trades on the platform.

- 3. Elliptic Elliptic applies AI to monitor crypto wallets for links to criminal activity. Their AI models can detect fraudulent activity like ransomware-related transactions or stolen asset movements, helping crypto businesses maintain regulatory compliance and customer trust.

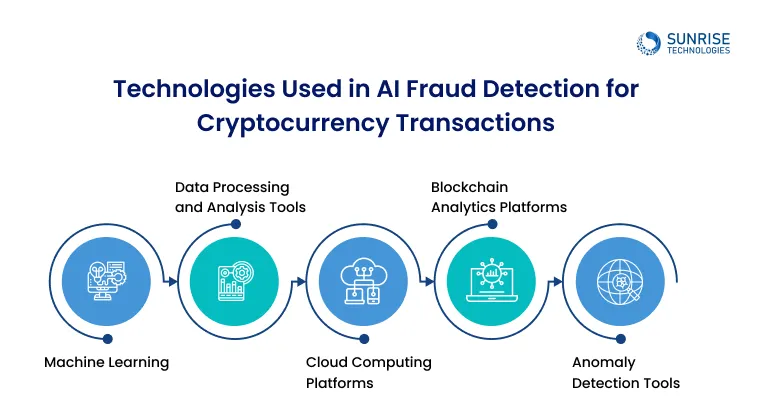

Technologies Used in AI Fraud Detection for Cryptocurrency Transactions

AI-powered fraud detection in crypto is a well-orchestrated blend of technologies that ensure proactive and real-time protection. Below are the core technologies driving AI fraud detection and cryptocurrency fraud prevention in today’s decentralized landscape.

Libraries such as TensorFlow, PyTorch, scikit-learn, and XGBoost form the foundation of AI fraud detection models. These tools are key to implementing machine learning in crypto security pipelines that can scale and adapt to rapidly evolving fraud patterns. These libraries offer:

- Pre-built components and deep learning architectures to accelerate model development.

- Flexibility for both supervised and unsupervised learning, essential for detecting anomalies and fraudulent transactions.

- Compatibility with GPU acceleration for high-volume crypto transaction monitoring in real time.

Working with blockchain requires managing vast volumes of transactional data. Libraries like Pandas and NumPy, along with distributed engines like Apache Spark, enable:

- Efficient data cleaning, transformation, and statistical analysis.

- Parallel processing of blockchain data to detect transaction patterns or anomalies.

- Enabling deeper blockchain anomaly detection and user behavior analysis.

Scalability is crucial in cryptocurrency fraud prevention, and platforms like AWS, Google Cloud Platform (GCP), and Microsoft Azure offer:

- On-demand GPU and TPU resources to train complex AI models.

- Scalable storage solutions for massive blockchain datasets.

- Seamless deployment pipelines for real-time fraud detection APIs.

- AI in blockchain security, especially in DeFi environments with 24/7 transaction flows.

Platforms like Chainalysis, Elliptic, Bitquery, and Crystal Blockchain are built specifically for crypto transaction monitoring. They provide:

- Real-time APIs to trace wallet addresses, token flows, and smart contract activities.

- Entity attribution, risk scoring, and visualization features.

- Crucial infrastructure for AI techniques for preventing money laundering in crypto and tracing illicit financial flows.

AI relies heavily on spotting deviations from the norm. Tools like Isolation Forest, One-Class SVM, Autoencoders, and platforms like Anodot or Seldon allow:

- Detection of outlier transactions that deviate from expected behaviors.

- Early warning systems for phishing attacks, abnormal wallet activity, or token manipulation.

- Reinforcement of DeFi fraud detection mechanisms.

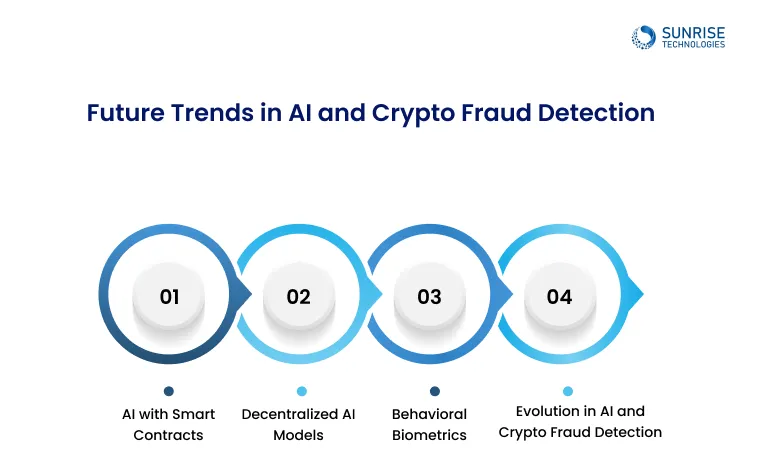

Future Trends in AI and Crypto Fraud Detection

The future of AI in crypto fraud detection is poised for significant advancements, driven by emerging technologies and evolving industry needs.

AI integration with smart contracts is set to improve transaction security by detecting fraud during execution. This ensures contracts are executed correctly, enhancing blockchain security for SaaS companies.

Decentralized AI models will increase transparency and resilience in fraud detection systems. These models are particularly important for the growing DeFi fraud detection landscape.

With stricter regulations expected, AI will help crypto platforms comply with evolving standards. This will drive more robust cryptocurrency fraud prevention mechanisms, ensuring compliance with global regulations.

The evolution of AI fraud detection in cryptocurrency transactions marks a pivotal shift in how we safeguard digital assets. With the increasing sophistication of fraudsters, traditional methods are no longer sufficient to combat the scale and complexity of modern crypto crimes. Machine learning in crypto security provides a critical edge, offering real-time detection, predictive analysis, and anomaly identification to tackle emerging threats. As the blockchain ecosystem grows, AI-powered fraud prevention becomes increasingly vital, ensuring that both centralized and decentralized platforms can defend against ever-evolving malicious actors. AI techniques for preventing money laundering in crypto are also becoming a key focus as regulations tighten globally.

At Sunrise Technologies, we are proud to be at the forefront of this transformation. As a top AI app development company, we specialize in implementing cutting-edge AI in fraud detection and AI cybersecurity solutions tailored for the crypto industry. Our expertise ensures that businesses are equipped with robust AI-driven tools to monitor and protect their transactions.

Let’s drive the future of secure crypto transactions with the power of AI.

Get expert consultation from the team of Sunrise Technologies on integrating AI-based fraud detection into your crypto infrastructure.

AI employs machine learning algorithms to analyze transaction patterns, identify anomalies, and flag suspicious activities in real-time, enhancing the efficacy of crypto transaction monitoring.

Tools like Chainalysis, Crystal Intelligence, and Hawk AI offer robust platforms for real-time cryptocurrency fraud prevention, combining blockchain analytics with AI capabilities.

Yes, machine learning models can detect irregularities in blockchain transactions, aiding in blockchain anomaly detection and enhancing overall security.

AI analyzes transaction flows and user behaviors to identify patterns indicative of money laundering, supporting compliance with anti-money laundering (AML) regulations.

The cost of integrating AI-powered fraud detection into a DeFi app can vary based on several factors, including:

- Tool/Platform Chosen

- Level of Customization

- Transaction Volume & Data Size

Startups can leverage lightweight or open-source AI crypto solutions from a few hundred dollars/month, while enterprise-grade setups with AML compliance scale higher. Partnering with an affordable AI development company like Sunrise Technologies ensures cost-effective, scalable integration.

Sam is a chartered professional engineer with over 15 years of extensive experience in the software technology space. Over the years, Sam has held the position of Chief Technology Consultant for tech companies both in Australia and abroad before establishing his own software consulting firm in Sydney, Australia. In his current role, he manages a large team of developers and engineers across Australia and internationally, dedicated to delivering the best in software technology.