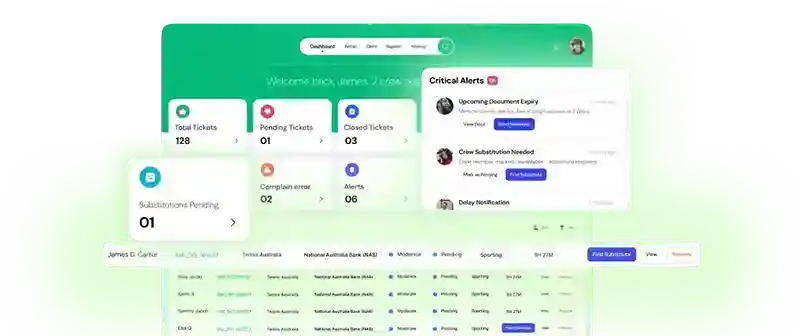

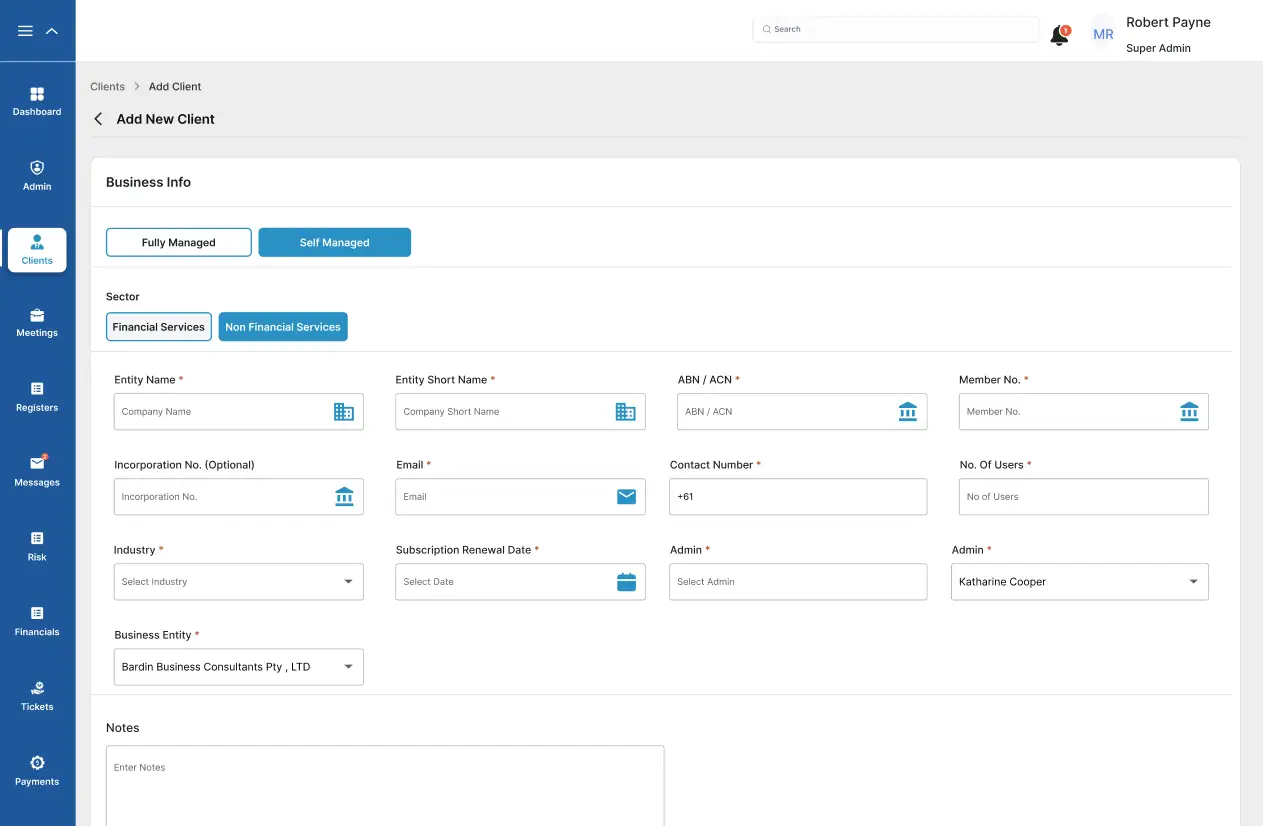

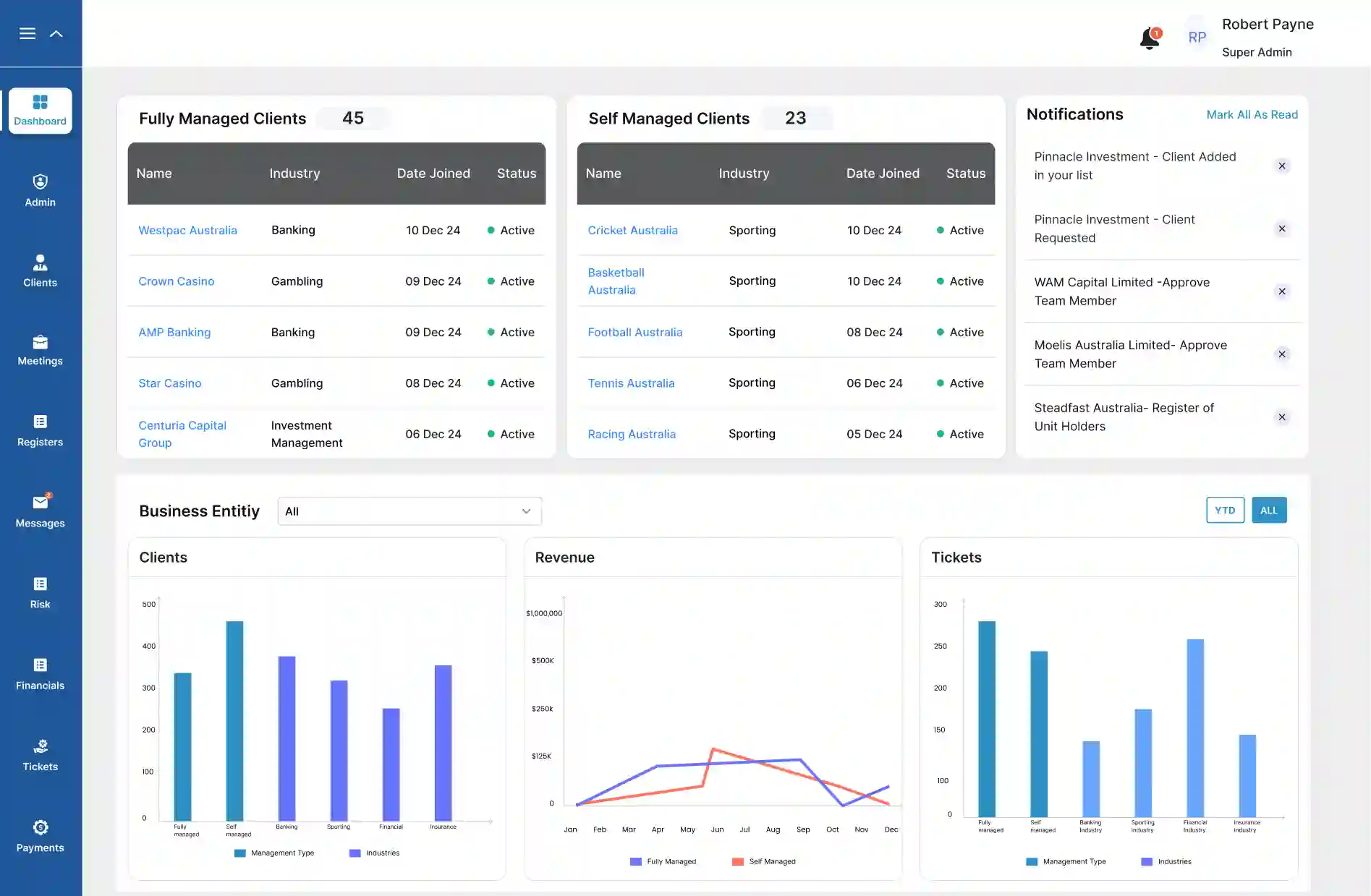

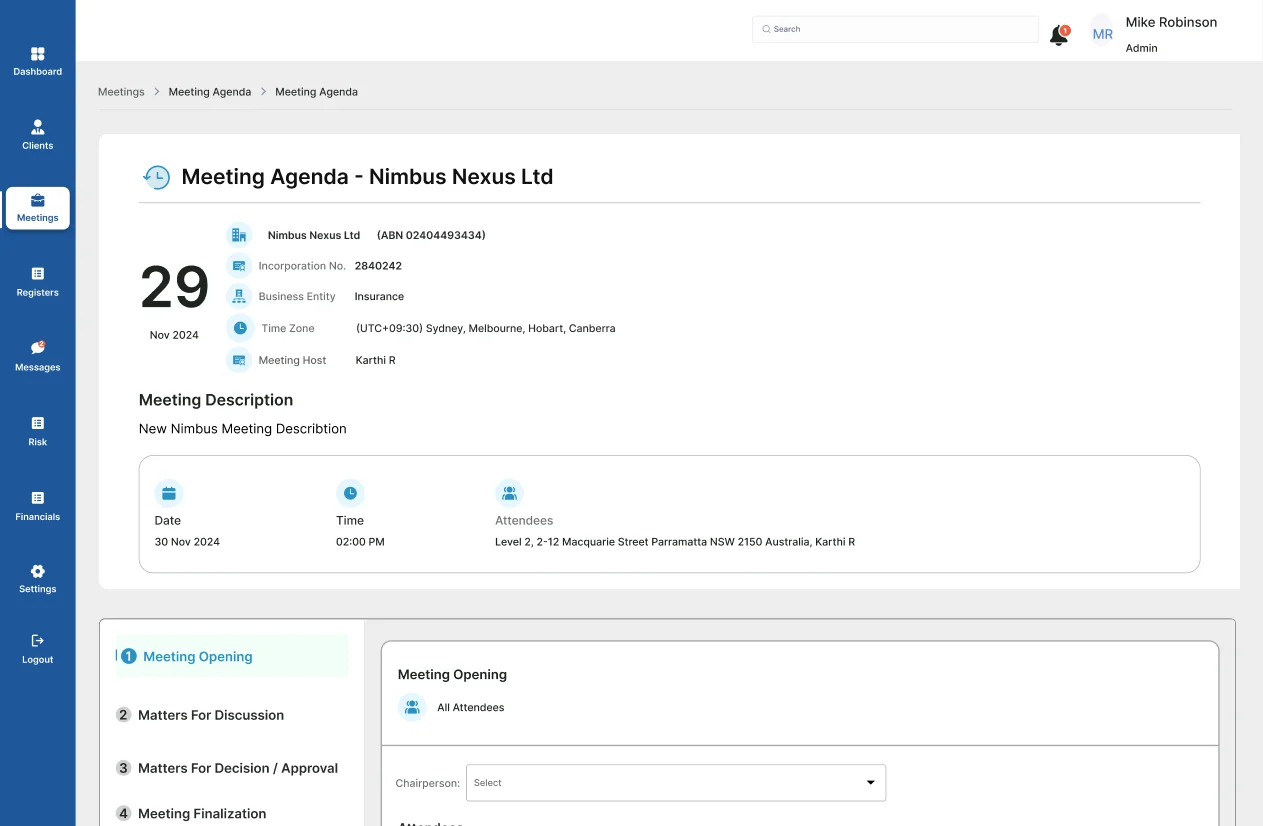

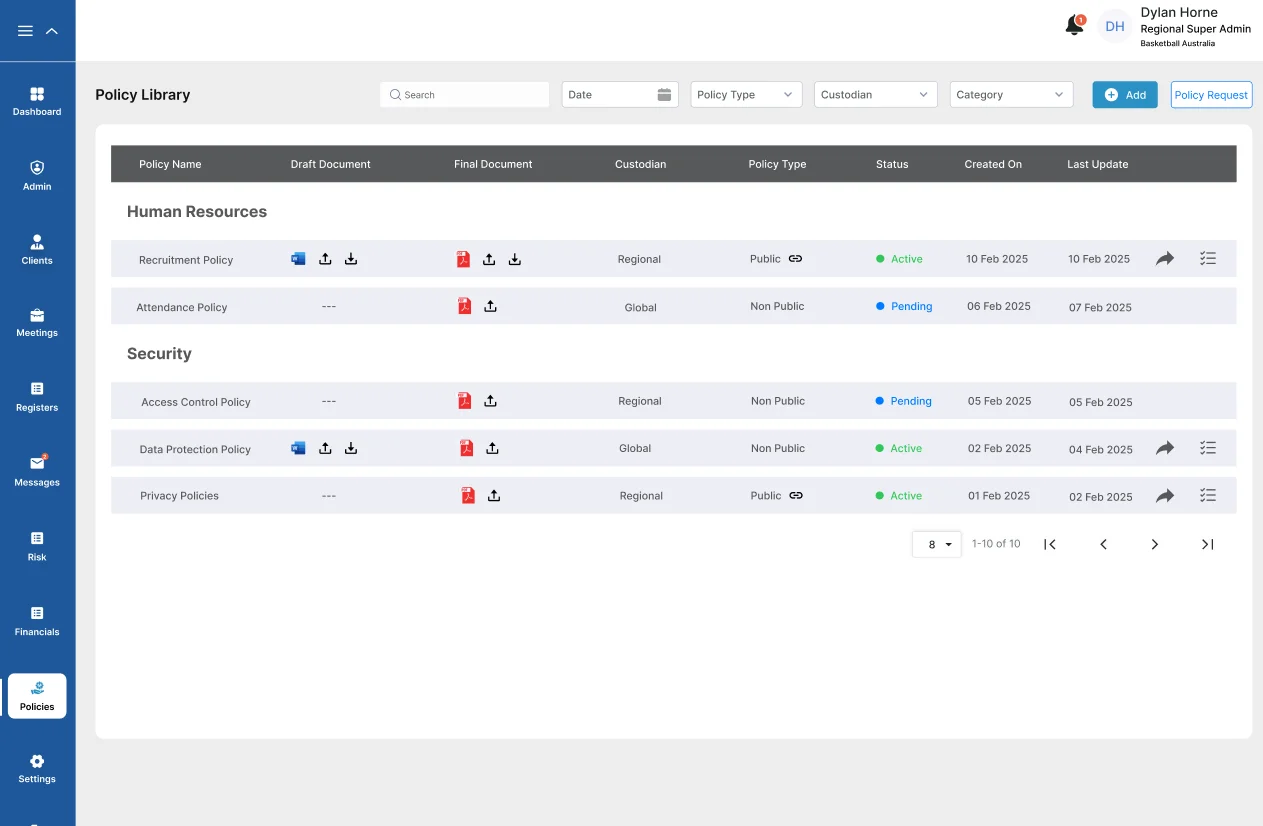

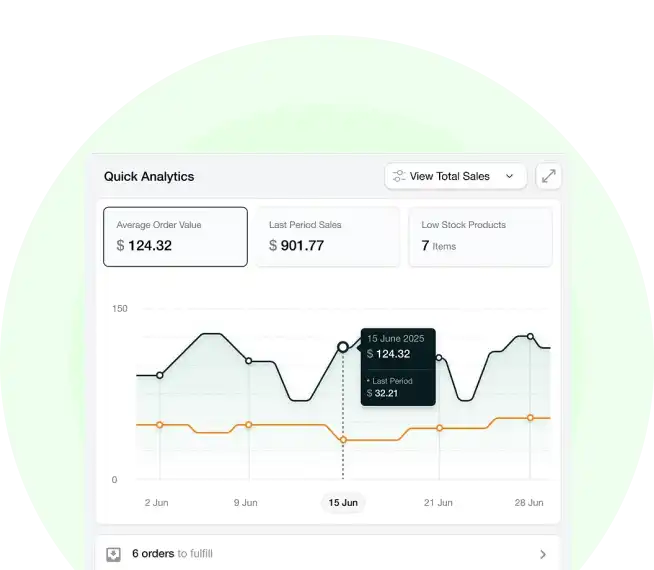

Build AI-Powered SaaS

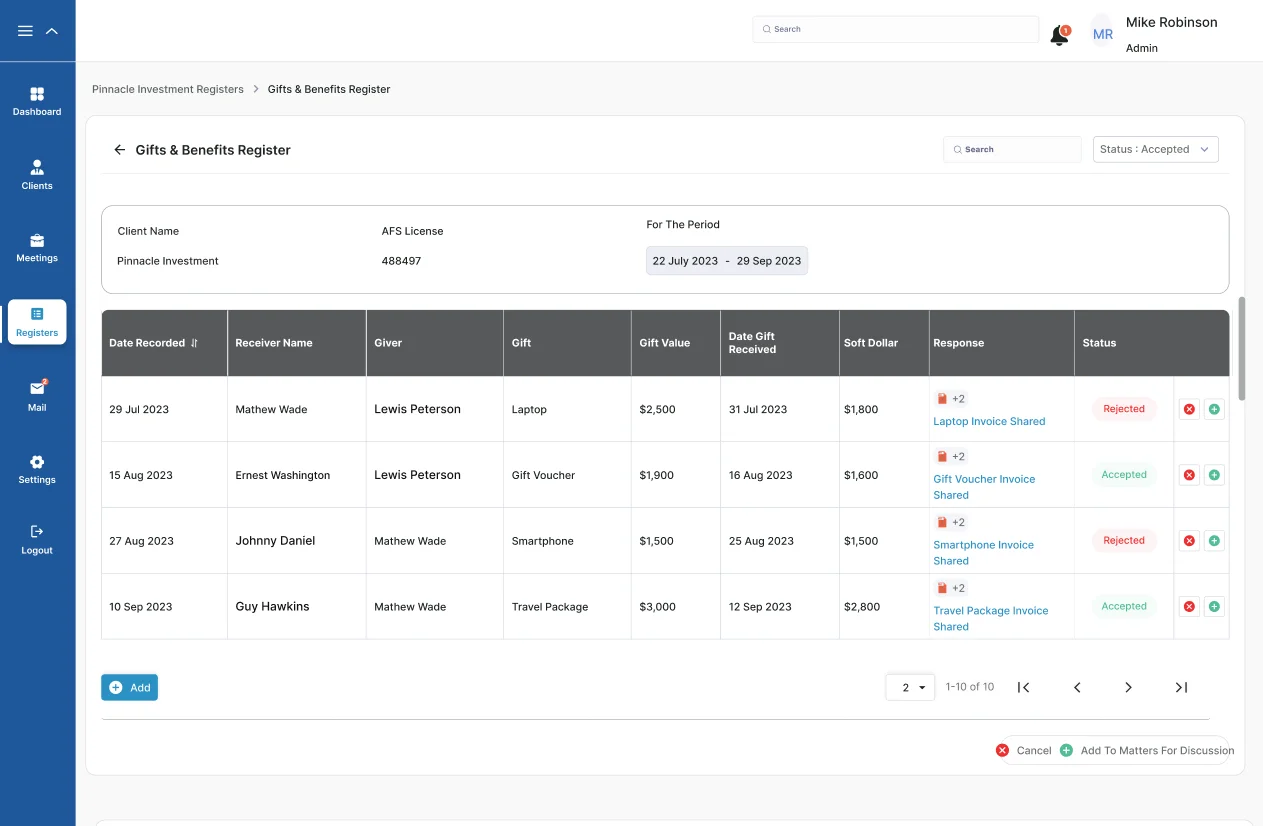

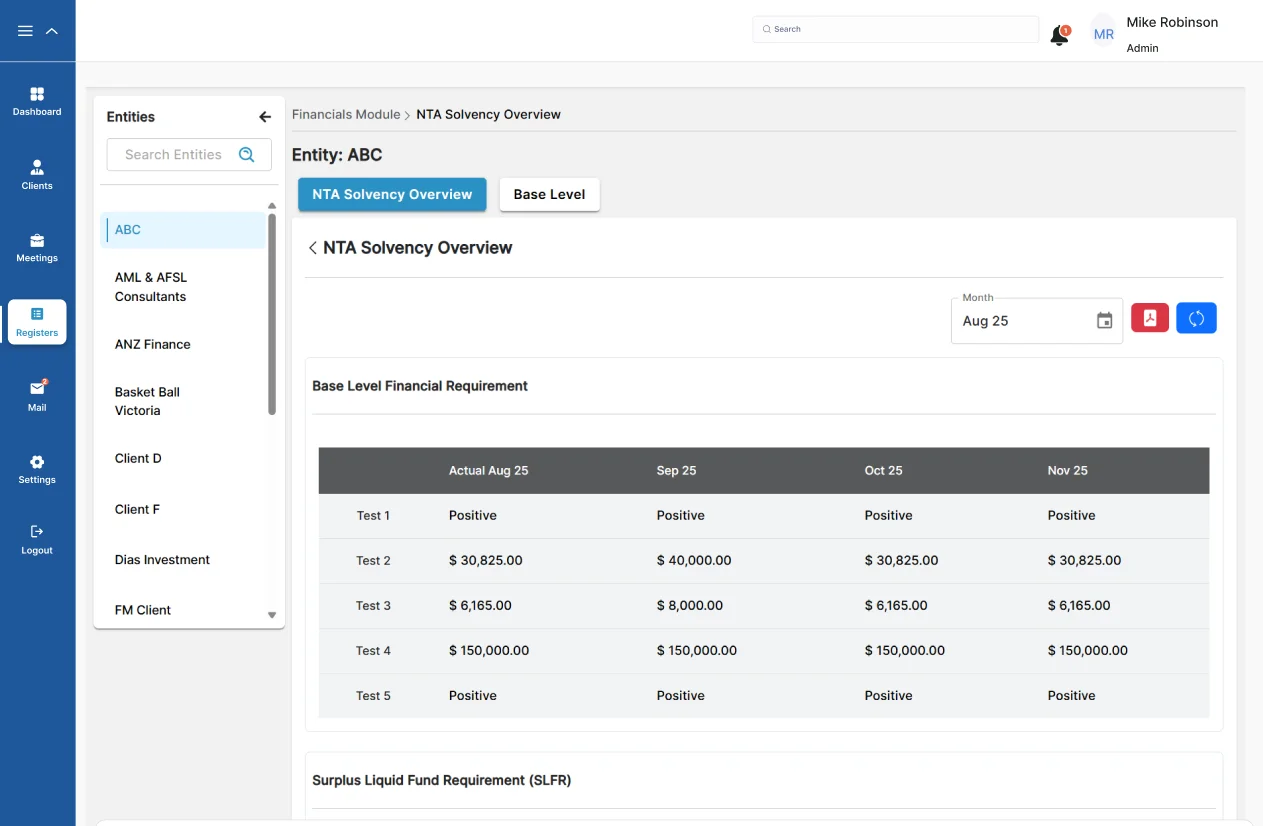

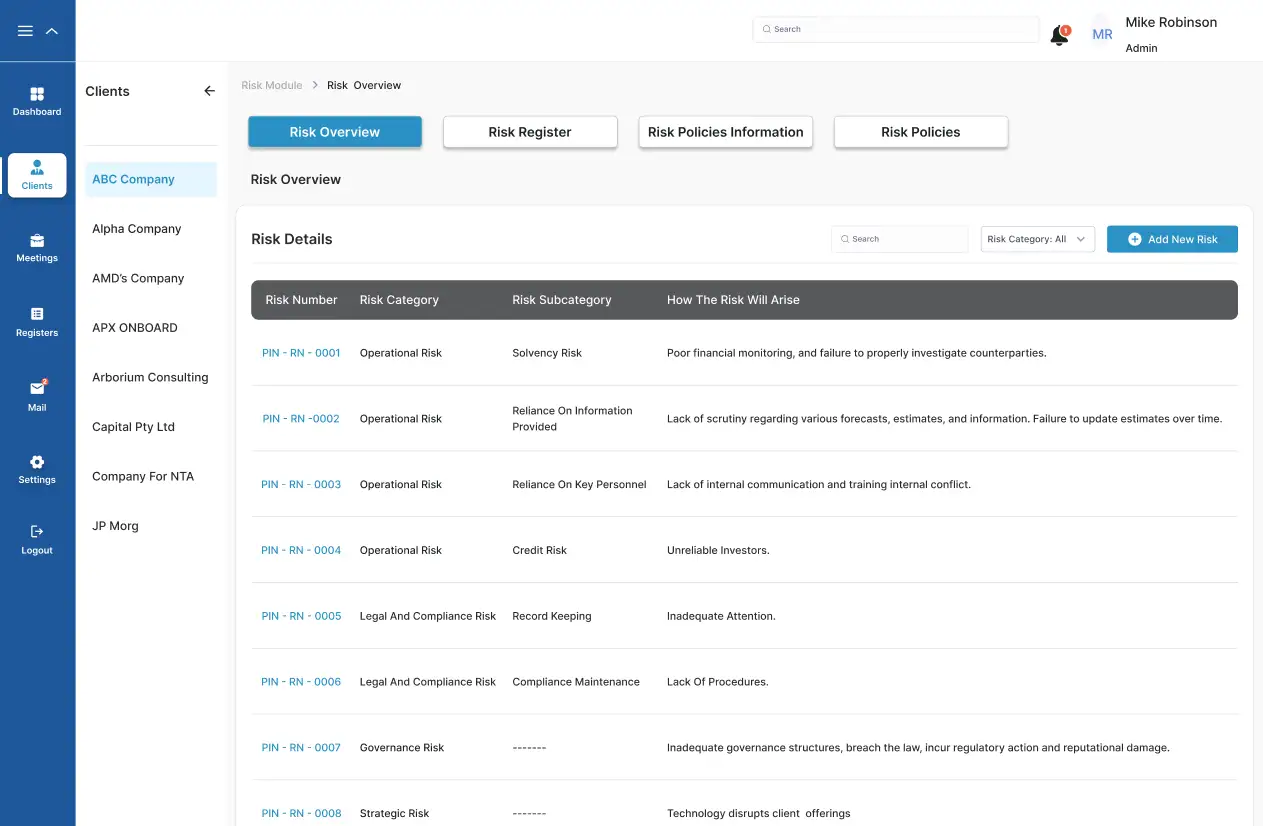

Financial

Compliance Platforms

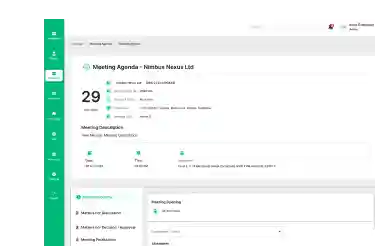

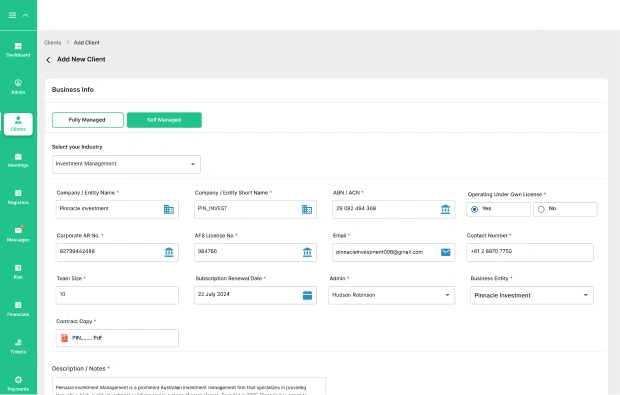

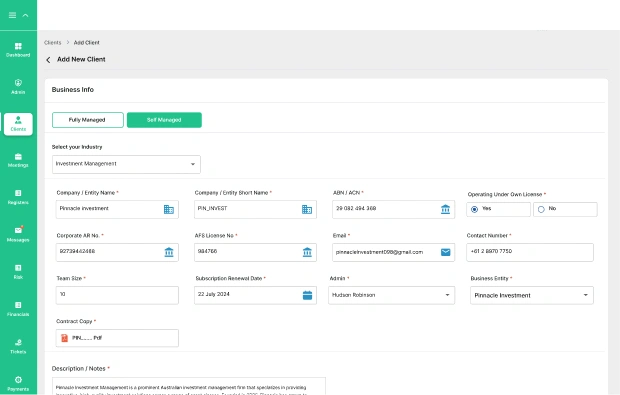

We helps financial institutions and enterprises automate regulatory processes, accelerate audits, strengthen data security, and reduce costs at scale. Our work on AI-Powered SaaS Financial Compliance Platforms proves what’s possible — 94% faster audit prep, $280K annual savings, and 7,200+ admin hours saved through intelligent compliance automation.